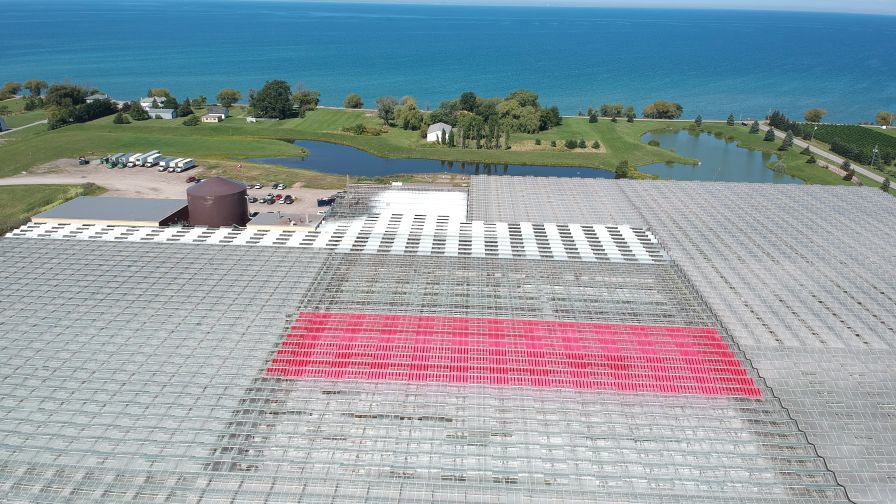

Freeman Herbs, located in Ontario, Canada, has used agrivoltaics for several years | Freeman Herbs

If you haven’t considered it, 2024 might be the year to add solar power to your operation. The available incentives combine to make a significant dent in the installation cost, but the time for some of those programs is limited. With current programs, up to 90% of the installation cost can be recouped in year one.

Navigating the choices and options for solar power is daunting. Trying to make sense of the changing incentives, loans, and tax programs available makes it worse. It’s a full-time job. Solar consulting and installation firms have specialists who keep track of the incentives, loan options, state and local programs, tax credits, and more. Let’s look at the current options to help ag producers and small businesses invest in solar energy, both traditionally and with agrivoltaics.

Rural Energy for America

You may have heard of the Rural Energy for America Program or REAP, administered by the USDA. You might not know that the Inflation Reduction Act of 2022 provided a significant but temporary funding boost to the grant program. It now covers up to 50% of solar installation costs for eligible producers. Whether or not your operation is eligible depends on a few factors, but the basic requirement is to be an agricultural producer or small business in a rural area.

You’ll need to get your ducks in a row to apply. There are two quarters left on the current funding, and unless Congress approves further funds, that will be it. The legacy program with a lower rate will likely continue. Upcoming application deadlines are Q4 (April to June 2024) and Q5 (July to September 2024).

Solar energy and agrivoltaics usage | Freeman Herbs

“Assuming you’re in an eligible location and meet the basic criteria, you can apply for the grant,” explains Warren Miller, Director of Sales and Marketing at Paradise Solar Energy. “They create a scorecard based on your industry, looking at how much energy you’re offsetting, how much you’re saving.” Applications are scored on a 0 to 100-point scale. Solar consultants can not only help design the system but also handle the grant application process for you.

Note: Regardless of state laws, REAP cannot be used to fund marijuana growing facilities.

Federal Investment Tax Credit (the ITC)

Tax credits are a more familiar and common way for the government to encourage business investment. Your tax professional should weigh in on any tax concern, but the gist of this one is 30%. According to the U.S. Department of Energy’s Federal Solar Tax Credits for Businesses webpage, “Solar systems that are placed in service in 2022 or later and begin construction before 2033 are eligible for a 30% ITC.”

Miller explains, “You can use it in the current year if you have a tax liability. If not, you can go back three years and recoup your taxes. And if you still can’t use it up, you can carry it forward.” Other potential add-ons to the ITC can boost the credit to 40-50%, depending on your situation.

Additional Options for Solar Installations

Beyond the federal grants and tax credits, more help exists to make solar installations and upgrades affordable. You’ll want to get your tax folks on hand for this one.

“Solar, just like any other equipment, can be depreciated. It falls under the five-year modified accelerated cost recovery system (ACRS) depreciation schedule,” says Miller. And you can accelerate up to 60% of the federal depreciation tax savings to year one.

Besides grants, the USDA also provides a loan guarantee program. REAP loans are for small businesses and ag producers to assist with installing renewable energy systems or making energy efficiency improvements. You can contact your state rural development energy coordinator for help with questions. Like other loan guarantee programs, the government isn’t actually lending the money, but the guarantee can help get a lender to approve the loan.

Other programs in your state can also make installing solar more affordable. Many states (38) have mandatory net metering, meaning your electric company will purchase excess energy you don’t need that your solar system produces during the day. You’re credited for that production and can draw against it at night or in cloudy weather. Think of it as storing your excess electrical production on the grid instead of in a battery. Solar Renewable Energy Credits (SRECs) and rebates or grants from your electrical provider may also be available.

Agrivoltaics Qualify for Incentives

If you’ve heard of agrivoltaics or agrophotovoltaics (APV) before, you might think of rows of traditional solar panels mounted in a pasture or at the edge of a field. That’s no longer the case. Several companies have produced commercial-scale semi-transparent solar panels meant to function as glazing on your greenhouse. It’s an exciting possibility to generate electricity to lower your energy bill while still maintaining yields. And best of all, it qualifies for the solar incentives mentioned above.

This tomato greenhouse in Greece uses Brite Solar panels | Brite Solar

Modern semi-transparent agrivoltaics use a straightforward approach. Traditional solar panels are opaque and completely covered with small individual photovoltaic cells. Agrivoltaics use those same individual cells, but fewer of them. They’re spaced apart to allow light to pass through. Think of a checkerboard where only the black squares have a PV cell, and the red squares are empty to allow light. Panels range from 75% transparency to 30% transparency, with the power output inversely proportional to the transparency.

You may be thinking that less light automatically equals lower yield or growth. After all, growers don’t purchase supplemental LED lighting because they need less light. However, field trials have shown interesting results. We talked with Marco de Leonardis, R&D Operations Manager at Freeman Herbs in Ontario. They’ve been using the panels for several years.

“In our greenhouse, we have the LUMO panels from Soliculture. In the six trials we ran, we noticed very little difference between the plants grown underneath the photovoltaic panel or underneath a control (clear glass). There was a little bit lower fresh weight, but the overall look of the plant was no different. Because we sell a finished plant, we can sell either.” According to manufacturer trials at commercial greenhouses, other crops can see an increase in yields.

The tech really shines in new construction because of the solar incentive programs. Since the greenhouse structure serves as the solar panel rack system, the entire structure’s cost is eligible for the programs, not just the cost of the solar. That’s huge.

“If you build a greenhouse with transparent solar panels that we manufacture, the entire cost of the greenhouse: construction, materials, etc., is all applicable to the ITC,” says Rick Orlando, VP of Business Development at Brite Solar. “If you look at the construction of a 100,000-square-foot greenhouse and compare the cost of building that with normal glass versus using our glass, with the 30% ITC, the glass gets paid for and you end up with free electricity. It’s a really compelling situation.”

If you’ve been on the fence about installing solar, the current incentive situation bears a closer look, because it might not be repeated.